9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

Collecting monthly rent payments is a key part of property management, but that doesn’t mean the process is always easy. In fact, many landlords struggle to establish a reliable rent collection process — but that’s why we’re here to help. This article will walk you through the most common rent collection problems before offering solid solutions to keep your bank account happy and healthy.

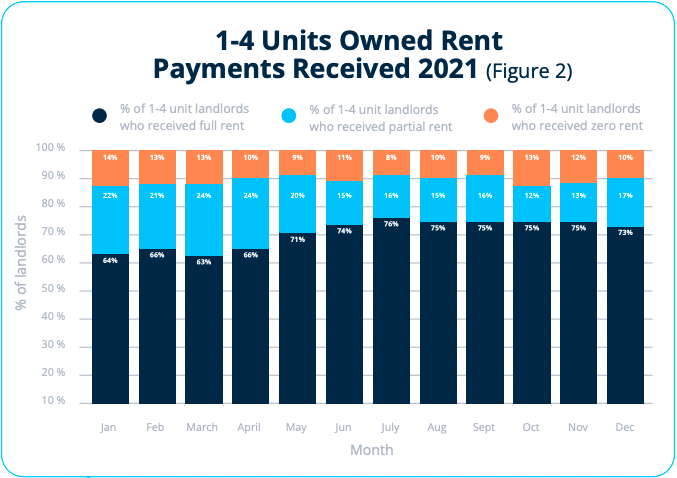

Not receiving any payments or only receiving partial payments are common pains experienced by landlords, and both of these issues were exacerbated by the COVID-19 pandemic. In fact, experts estimated that renters owed approximately $70 billion in back rent at the end of 2020. 2021 saw improvements to the number of full payments being made, and landlords with 1-4 units received the highest amount of full rent payments along with the most missed rent payments:

Only 60% of urban landlords received full payments last year, but 32% received partial payments.

You want your renters to pay their monthly rent in a timely manner, right? While your lease agreement should clearly outline the due date and rent amount you’re owed each month, there’s more that you should (and shouldn’t) do to set yourself up for success. According to RentRescue, you need to:

When looking for prospective tenants, it’s crucial to understand the results of their tenant screening report. Look specifically at their eviction history — have they been asked to leave a former residence due to nonpayment?

What do the credit bureaus say about this individual’s financial history? As you look through various applications, keep in mind that someone whose payment history reveals problematic behavior could be more of a hassle than they’re worth. Not every jurisdiction allows for a robust background check, which is where a pre-screener can be really useful. Most importantly, you want to get a good feel for the trustworthiness of the person you’re potentially housing.

Life happens, and the best landlords are compassionate toward their renters when things don’t go exactly according to plan. Whether they had to buy a new car after theirs was rear-ended or a family member’s hospital bills have zapped their checking account, it’s possible that even the best tenants will have to make a late payment every once in a blue moon.

But you need to balance your compassion with the rules as defined in your lease agreement. That’s why we recommend clearly defining how long of a grace period you’ll allow after the monthly rent’s due date along with late fees your tenants will be expected to pay. You’ll also want to consider whether or not you’ll allow partial payments before your renter moves in. Hold everyone to the same rules and you’ll avoid the stress of giving someone an inch only to watch them take a mile.

Since your lease should specify how many business days your tenant has to pay their rent, don’t be shy about charging late fees. Check your local landlord-tenant laws to determine the amount you’re authorized to charge. RentRescue further recommends answering the following questions when adding a late fee policy to your lease:

Pro Tip:

You can now set up automatic late fees within your TurboTenant account! This makes it much easier to stay on top of your monthly rent collection.

Most states require landlords to send a “pay or quit” notification if their tenant doesn’t pay rent. This notice outlines how many days they have to either provide payment or vacate the rental property. Hopefully, the renter will make their payment within the notice period. If not, then you can formally terminate their lease agreement and begin the eviction process.

Despite the frustration that these situations can cause, remember that you cannot perform a “constructive” eviction — meaning you aren’t legally allowed to make your real estate uninhabitable to push the tenant out. For example, you can’t change the locks, remove the plumbing, block the entrance, or shut off their utilities without facing steep penalties.

The best property management software makes reporting rental payment history simple and straightforward, which will benefit you and your tenant alike. When your tenant activates Rent Reporting through their TurboTenant account, your renter’s payments will be automatically reported to TransUnion, meaning they can bolster their credit score and have further incentive to pay the rent on time.

Keep in mind that you can and should report late rent payments to the various credit bureaus. If your tenants know that late payments will be reported, they’ll be more likely to make on-time rent payments.

By following the tips above, you’ll set yourself up for success when it comes to collecting rent on time and in full. But there’s something else you can do to streamline the process: allow online rent payments through a trusted property management app.

Online rent collection unlocks a variety of payment options. Whether you decide to accept ACH payments, credit card/debit card charges, or bank transfers, a rent collection app can make it easy for your tenants to pay their monthly rent. If you collect rent online, you don’t have to worry about bounced checks or other outdated payment methods. Instead, your tenants can receive automatic rent reminders while you enjoy payment tracking to ensure that your financials stay organized, clean, and healthy.

Pro Tip:

Although you may be tempted to allow tenants to pay rent through services like PayPal or Venmo, bear in mind that these pieces of software aren’t designed for landlords, which can make collecting late fees more challenging. Conversely, online rent collection software created for landlords offers useful features like autopay and rent reporting.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...