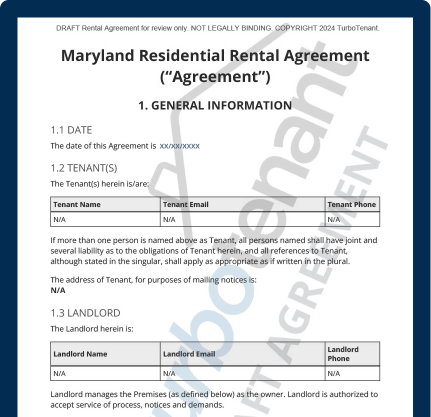

Maryland Residential Lease Agreement

A Maryland lease agreement is a legal contract outlining the terms of renting property. Landlords hand over possession of the property in exchange for rent payments.

They typically include:

- Critical details about the duration of the lease, rent amount and due date, payment methods accepted, and security deposit information

- Tenant and landlord obligations governing what is and isn’t allowed during the rental period

- The conditions for terminating the lease or if the lease will automatically transition to a month-to-month arrangement when the lease term ends naturally

In this Maryland lease agreement guide, we’ll cover the required disclosures and laws for the entire state; we won’t get into specifics surrounding Montgomery County and Baltimore.

But know this: our Maryland residential lease agreement template covers those counties, so while this guide doesn’t detail the laws in those areas, you can still build a complaint lease with TurboTenant, no matter your location in Maryland.

Maryland Lease Agreement

Current PageTurboTenant's Maryland lease agreement forms the backbone of a solid landlord-tenant relationship.

Maryland Rent Control Laws 2024

Current PageLooking for Maryland rent controls laws? You found them.

Maryland Landlord-Tenant Law

Landlord-tenant laws vary from state to state or even county to county, affecting key elements of renting property, like the amount the landlord can charge for security deposits, rent grace periods, and eviction proceedings.

When creating a new lease, landlords must include state-mandated disclosures or language and follow all relevant laws to avoid an invalid agreement that the court system could void. Again, our Maryland lease agreement template can help eliminate the guesswork of creating compliant leases anywhere in Maryland.

Required Landlord Disclosures (6)

Disclosures are like lease addendums, providing the tenant with additional information about the rental property and allowing landlords to highlight necessary aspects of the unit.

Maryland law requires the following disclosures:

- Lead-Based Paint: The only federally required disclosure concerns lead-based paint and its hazards. Landlords of units built before 1978 must inform tenants of these hazards at lease signing.

- Landlord Identification: Maryland landlords must provide the name, address, and phone number of the landlord or person authorized to manage the property. (MD Code, Real Property § 8-210).

- Security Deposit Receipt: When accepting a security deposit, landlords must provide the tenant a written receipt that lays out the Maryland rules for handling and returning the deposit, as well as the right for landlords to inspect the property with notice (MD Code, Real Property § 8-203(c)(1), 8-203.1).

- Shared Utilities: If utilities are split between units, the landlord must disclose how the payments are divided among tenants (Tenant Protection Act of 2022).

- Habitability Disclosure: The lease agreement must include a statement on habitability and safety, listing any known defects, and information on who will be responsible for their repair (MD Code, Real Prop. Sect. 8-212).

- The 2024 Renters Rights and Stabilization Act must be attached to the lease.

Security Deposit Regulations

Maximum Security Deposit Amount: As of October 1, 2024, Maryland landlords are legally allowed to charge up to one month’s rent for the security deposit (MD Code, Real Property § 8-203(b)(1)).

Receipt of Deposit: Landlords in Maryland must provide a detailed receipt of the security deposit when it’s accepted (MD Code, Real Property § 8-203(c)(1), 8-203.1).

Interest: Maryland landlords must pay interest on security deposits and keep them in interest-bearing accounts at a rate of either 1.5% per year or the amount based on the US Treasury yield curve, whichever is greater (MD Code, Real Property § 8-203(e)(1)).

Deduction Tracking: Landlords may withhold funds from the security deposit for unpaid rent or damage to the unit beyond normal wear and tear. They must provide an itemized list of reductions within 45 days of the lease end date (MD Code, Real Property § 8-203(f)(1)(i)).

Returning a Tenant’s Security Deposit: Security deposits and the itemized list of repair reductions must be returned to the tenant within 45 days of the end date of the lease term (MD Code, Real Property § 8-203(g)(1)).

Landlord’s Access to Property

Advance Notice: Landlords may enter a tenant’s property anytime for reasonable purposes, like maintenance and emergency repairs, but the state does not provide specific guidelines.

Immediate Access: Maryland does not specify how a landlord may enter the property, so entering the property for emergency repairs is allowed.

Landlord Harassment: Although Maryland law does not dictate how a landlord can enter a tenant’s unit, excessive entry could qualify as landlord harassment. Tenants must petition the court, but they may be able to break the lease early and without penalty in cases of landlord harassment (MD Code, Real Property § 8-204).

Rent Payment Laws

Grace Period: Maryland has no mandatory grace period for late rent payments.

Late Rent Fees: The maximum late rent fee in Maryland is 5% (MD Code, Real Property § 8-208(d)(3)).

Tenant’s Right to Withhold Rent: Tenants may be able to withhold rent when a landlord does not repair an emergency condition within a reasonable timeframe by bringing an action of rent escrow to the court (MD Code, Real Property § 8-211(i)).

Breach of Rental Agreement

Missed Rent Payment: Once a rent payment is late, landlords may deliver a 10-day notice to pay or quit (MD Code, Real Property § 8-401(c)).

Lease Violation: Maryland landlords may deliver tenants a 30-day notice to quit upon noticing a lease violation. They do not have to give the tenant the option to cure (MD Code, Real Property § 8-402).

Self-Help Evictions: Landlords should never attempt self-help evictions; they are illegal. The proper eviction process should be followed in all eviction matters.

Lease Abandonment: A tenant who breaks a lease early and without a qualifying reason could be subject to legal penalties and the remainder of the rent due on the lease period. However, Maryland landlords must attempt to re-rent the unit at fair market value, availing the tenant of the remainder of the rent due (MD Code, Real Property § 8-207).

Ending a Lease

Month-to-Month: Maryland landlords may terminate a month-to-month lease with at least 60 days written notice, but tenants may terminate with 30 days’ notice(MD Code, Real Property § 8-402(c)(2)).

Fixed-Term: Tenants can break a lease without penalty if they meet qualifying conditions, such as entering active military duty, landlord harassment, domestic violence, or if the tenant dies before the end of their lease term.

Property Abandonment: Maryland landlords are not obligated to attempt to return or store property left behind by tenants once they leave the rental unit for good (MD Code, Real Property § 8-208(d)(6)).

Renewing a Lease

Required Renewals: Landlords in Maryland are not obligated to renew a tenant’s lease once the lease term ends.

Required Notice: Maryland landlords must provide at least 60 days’ notice when they intend to terminate a tenant’s month-to-month lease and 90 days’ notice when they intend not to renew a yearly lease. They are not required to notify the tenant when a fixed-term lease ends and will transition to a month-to-month agreement (MD Code, Real Property § 8-402).

Rent Control & Stabilization

The state of Maryland does not have rent control. However, some local jurisdictions tie a rent control structure to the inflation rate. Landlords should know their local guidelines before raising a tenant’s rent.

Maryland Lease Agreement FAQs

Does a landlord have to provide a copy of the lease in Maryland?

Landlords in Maryland must provide a written copy of the lease if the tenant requests it in writing.

What is the grace period for rent in Maryland?

There is no mandatory grace period for rent established by Maryland state law.

Can a landlord refuse to renew a lease in Maryland?

Landlords can refuse to renew a month-to-month lease by providing the tenant with at least 60 days’ notice and a yearly lease with at least 90 days’ notice.

Does a Maryland lease need to be notarized?

Maryland leases do not need to be notarized.

Can you withhold rent for repairs in Maryland?

Tenants may be able to withhold rent for repairs if landlords do not make necessary repairs in a reasonable timeframe and the action is brought to the court (MD Code, Real Property § 8-211(i)).