Rent Reporting

Pay Rent on Time. Build Your Credit History.

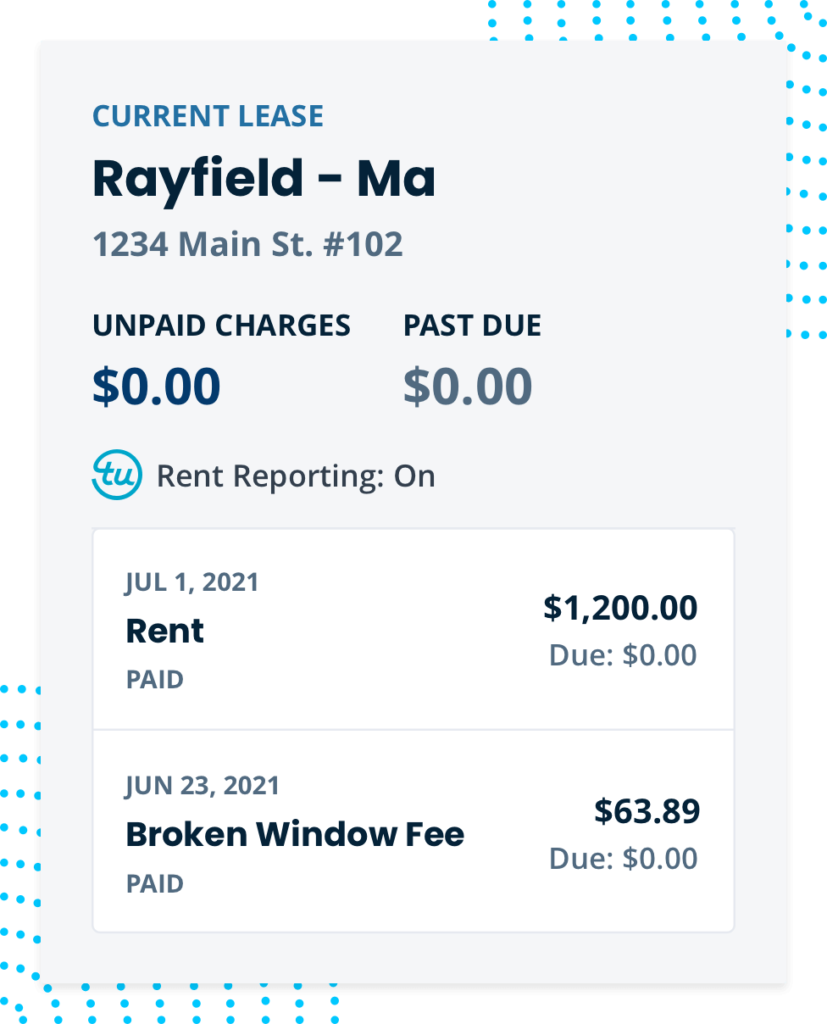

Build your credit history simply by paying rent on time. Once you subscribe to Rent Reporting, TurboTenant will automatically report your on-time rent payments to TransUnion, helping you get the credit score you deserve.

Are you a landlord? Learn how to collect rent through TurboTenant so you can report your tenant’s on-time payments. You can also read more about the benefits of offering this service in this article.

The Why

You Work to Pay Rent.

It’s About Time Rent Works for You!

Rent is one of your largest monthly bills. Why not make it work to your advantage?

Benefits for Tenants:

- Build credit history simply by paying rent on time

- Contribute to your credit score without taking on any additional debt

- Achieve financial goals, like approval for a car loan or mortgage

Why Landlords Love It:

- Reduce late rent payments by incentivizing on-time ones

- Stand out with this unique offer for renters

- Help your tenants improve their financial situation

How it Works

Step-by-Step Breakdown

1. Invite your landlord.

Easily invite your landlord to collect rent online. Once they create a free TurboTenant account, they will invite you to create your own renter account. Your landlord will then set up online rent payments, and you can securely connect your bank account.

2. Subscribe to Rent Reporting. Only $4.99/month.

You should be rewarded for paying rent on time! Simply activate your Rent Reporting subscription within your renter account once your landlord has set up online payments. You will be asked to provide information, such as your legal name and date of birth, before it is fully activated.

3. Pay your rent to build your credit.

Once Rent Reporting is enabled, TurboTenant will automatically report only your on-time rent payments to TransUnion, whether you pay through TurboTenant or your landlord tracks rent payments using TurboTenant. You can unsubscribe from Rent Reporting at any time.

Still have questions? Check out our FAQs below!

Rent Reporting FAQs

How do I set up Rent Reporting?

To begin, simply invite your landlord to collect rent online through TurboTenant. Once online rent payments are set up, you’ll be able to opt into Rent Reporting within your TurboTenant account after confirming some information. Once you’ve enabled Rent Reporting, we will automatically report every on-time payment you make online or that your landlord records to the credit bureau, TransUnion. Have additional questions? Please contact [email protected].

How do I check my credit score?

The Federal Trade Commission entitles everyone to a free credit report every 12 months, which can be requested. TurboTenant reports credit to one of the three major credit bureaus. For more information on getting your credit report, you can visit the Federal Trade Commission’s website.

Should I report my rent payments?

Generally, your rent payments don’t get reported to credit bureaus, unlike your credit card or mortgage payments. But if you are looking for a way to build your credit history without taking on additional debt, reporting your on-time rent payments can be an excellent option for doing so.

What is an acceptable credit score for a renter?

While acceptable credit scores vary from landlord to landlord, generally a good credit score to rent an apartment ranges from 620 to higher. Check out our comprehensive guide on how to run a credit check.

How much can I expect my score to increase?

TurboTenant cannot control or guarantee a particular change in your credit score. However, scores typically increase the most for renters who lack credit history or have low scores. Once you have a consistent history of on-time payments, you can check your credit score for free.

Who is Rent Reporting good for?

Rent reporting can benefit everyone but is especially helpful for renters who lack any credit history and renters with a low credit score. You’ll build your credit history without taking on additional debt.

What is TransUnion?

TransUnion is one of three trusted credit bureaus that are responsible for collecting and maintaining consumer credit reports in the U.S. These reports are then provided to subscribers, such as landlords, mortgage lenders, etc., who decide whether or not to extend you credit or accept you as a tenant.