Protecting Your Rental Property Investment

Investing in rental property is a great way to build wealth – but you can’t afford to risk your business because you didn’t use the right tools to keep your portfolio safe.

Set up your rental property business to thrive for years to come in three steps:

Optimize Your Tenant Screening Process

Buy Landlord Insurance

Require Renters Insurance

Optimize Your Tenant Screening Process

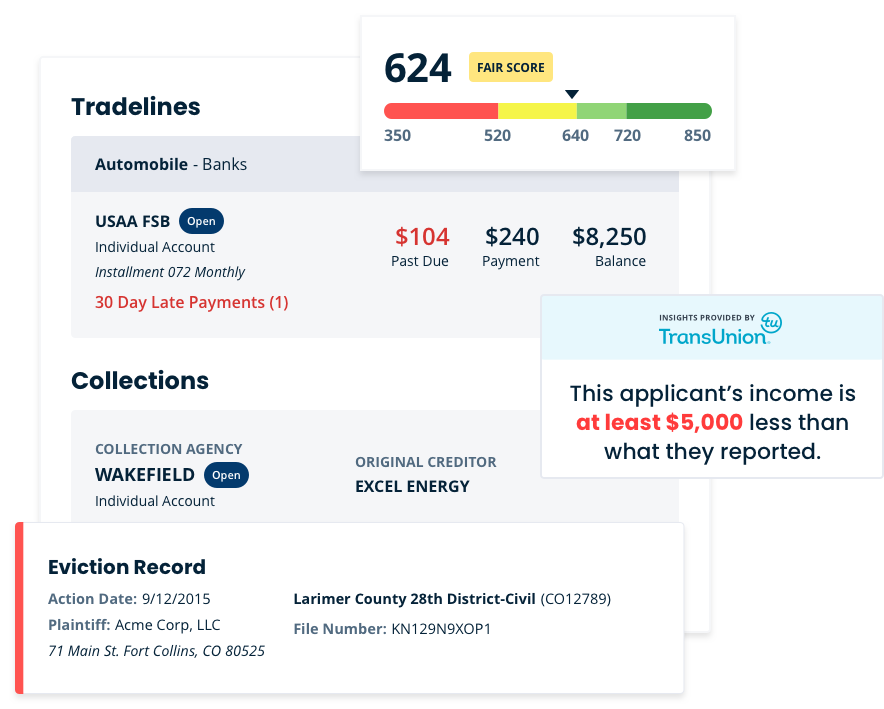

Take the guesswork out of finding the right renter with TurboTenant’s comprehensive screening report and rental application, and learn about an applicant’s credit, eviction, and criminal background history in three simple steps.

To Screen a Tenant:

- Enter their email address.

- TurboTenant verifies their identity.

- You receive the report!

Want to take your screening efforts a step further? Landlords who subscribe to TurboTenant’s Premium plan unlock Income Insights from TransUnion to check the accuracy of the applicant’s reported income.

Buy Landlord Insurance

Unless you live alongside your tenant, you need to buy landlord insurance – not homeowner insurance – to safeguard your investment. A robust landlord insurance policy protects against property damage, loss of rental income protection, and liability cases.

If you’re already insured, you could save hundreds of dollars every year by reevaluating your policy with our trusted partner, Steadily.

Steadily has over 500 customer reviews and is rated “Excellent” on TrustPilot, so you know you’re in good hands.

Require Renters Insurance

Renters insurance protects your tenant’s belongings from accidents, natural disasters, malicious actions, and liability cases – but only 37% of tenants purchase renters insurance on their own.

That means 63% of renters are more likely to reach out to their landlord first in cases of emergency, which can increase your out-of-pocket costs and your stress levels.

By acquiring landlord insurance and requiring your tenant to carry renters insurance, you can rest assured that both your property and tenant are covered.

Subscribe to TheKey, the weekly newsletter that delivers industry trends, tips, and tricks to support every stage of the landlord process.

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!