9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

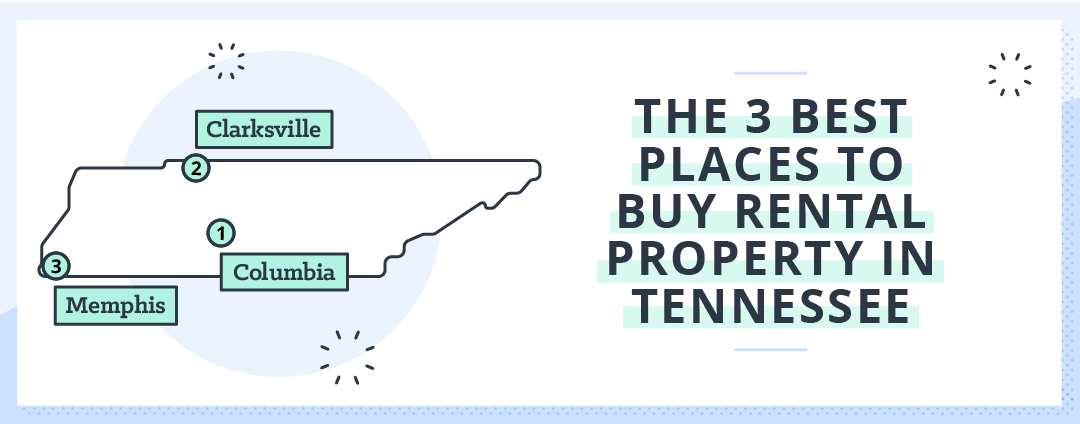

In this edition of The TurboTenant report, we will be focusing on the best places to buy an investment property in Tennessee. Three towns made our list: Columbia, Clarksville, and Memphis. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

Tennessee is bordered by eight states, the Appalachian Mountains dominate the eastern part of the state and the Mississippi River forms the western border. Tennessee’s major industries include agriculture, manufacturing, and tourism. Nashville, Tennessee’s capital is known as “Music City” the country music capital of the world. Nashville didn’t make our list, but Memphis did and it has a great music, arts, and culinary scene as well-Memphis BBQ anyone? Memphis is also home to Graceland, which a 22-year-old Elvis purchased for 100k in 1957. The median sale price in Memphis isn’t much higher than that right now and sits at 129k as of October 2019. Leads are very strong in all cities and the days on market is less than 20 for all locations. Let’s check out the best places to buy a rental property in The Volunteer State.

Memphis is home to the most famous residence in rock n’ roll history, and it could be home to your next rental investment property for just a bit more than what Elvis paid for Graceland in 1957. As we said above, the median sale price is 129k as of October of 2019, and the average rent price is hovering at around $821. Leads are very strong at 55 per property with just a little over two weeks on the market. You can’t help falling in love with Memphis, and it’s great investment opportunities.

Clarksville is the 5th largest city in Tennessee with an estimated population of 160k. Clarksville is the home of Austin Peay State University and Fort Campbell Army base, which spans the Tennessee-Kentucky state line. It is also home to one of the oldest newspapers in Tennessee, The Leaf-Chronicle. Numbers are very strong across the board for our #2 town. Population growth, employment growth, and home values all show strong increases year over year. The median sale price is $190k with an average rent of $757. Leads are very strong at 57 on average per property, and the average number of days on the market is just 18.

Our number one town, Columbia is the self-proclaimed “mule capital of the world” and celebrates Mule Day annually in April. Columbia is also the “Antebellum Homes Capital of Tennessee” and has more antebellum houses than any other county in the state. Home values have seen a double-digit year over year increase at 16.2%, population growth is up 5.7% and employment growth is up 4.4%. Columbia properties receive a whooping 105 leads on average and just 8 days on the market. Columbia is our self-proclaimed “rental investment capital of Tennessee.”

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

Use our handy map tool to explore top rental markets throughout the U.S.

Use our handy map tool to explore top rental markets throughout the U.S.

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...