12 min read

Beyond Traditional Loans: 14 Creative Financing Options for Real Estate Investing

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

Although the goal is to avoid property damage, it’s inevitable that a landlord will need to write a denial of security deposit letter. You’d send a denial of security deposit letter when some or all of your tenant’s security deposit will not be returned. If you don’t follow the correct legal process, you’ll risk a costly lawsuit.

We’ve outlined what steps to take if a letter does need to be sent, as well as ways to avoid the potentially complicated situation of keeping a portion of a tenant’s security deposit, below. We’ve also created a sample letter to the tenant for damages.

Landlords are legally allowed to collect security deposits in every state and may use all or a portion of the deposit to cover any damages caused by the tenant that exceed normal wear and tear. The law also states that landlords are required to return security deposits in full or notify tenants if any portion of their deposit has been withheld.

It’s critical to know your state’s landlord-tenant laws, as the notification requirements specifics vary from state to state.

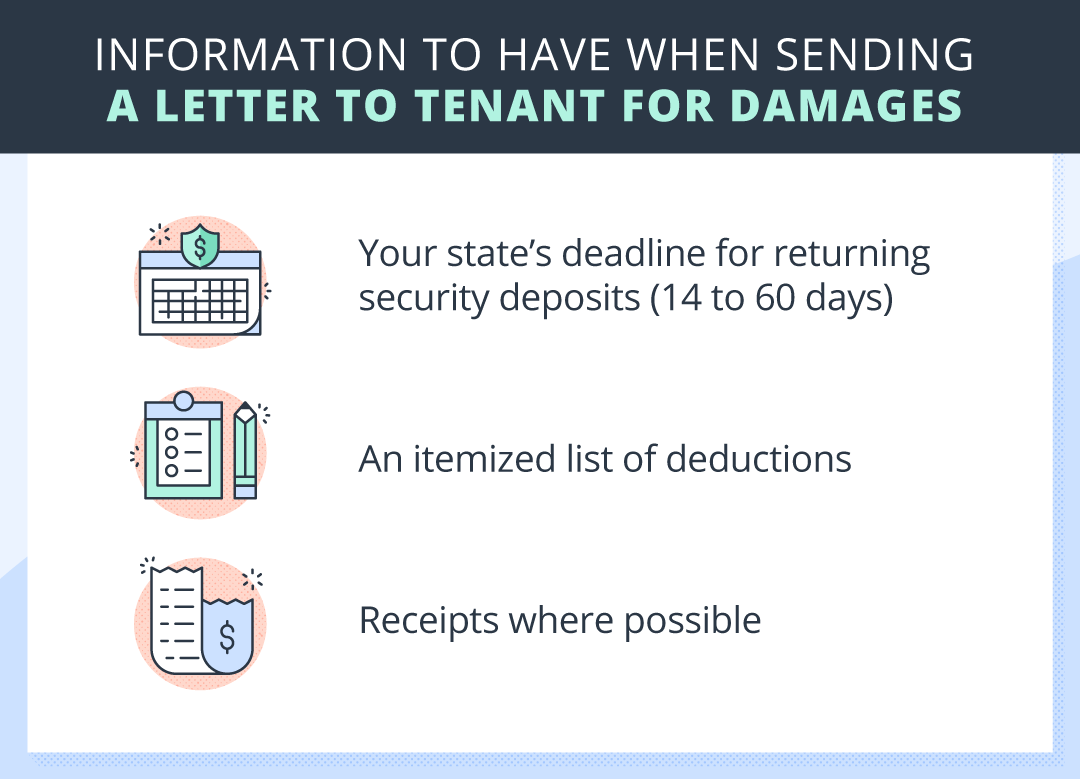

Generally, a landlord must send a physical letter that includes the security deposit returned in full or explains why they are keeping some or all of the security deposit. This must be done within a certain specific time frame, usually 14-60 days of the tenant’s departure. Make sure to include the following when writing a letter to notify tenants of damages:

Here is a sample landlord letter to a tenant for repairs.

Communicating about damages with a tenant can be challenging and time-consuming, especially if the tenant refuses to accept responsibility. Unfortunately, a landlord could potentially find themselves having to demand additional funds in order to cover damages that exceed the amount of the security deposit.

In order to avoid these situations, landlords should always take the following steps as a precaution:

A background check assists landlords in learning more about an individual’s past. It is important to be aware of a prospective tenant’s criminal history in order to avoid renting to someone that is dishonest or even dangerous.

A credit report can give a landlord insight into a prospective tenant’s finances. A landlord will want to ensure a prospective tenant is financially responsible and has a history of making payments on time. Individuals that have a history of being late on payments or debt may be less willing or able to pay for damages.

Did You Know?

With TurboTenant Premium, you have access to comprehensive income verification on every tenant screening report.

An eviction report provides details that may not show up on a credit report or criminal background check, such as the specific reasons for eviction. The tenant may have broken rules such as being too loud at night or housing a pet. Keep in mind evictions only stay on an individual’s public record for up to seven years.

Learn more about evictions in our free webinar:

Tenants and landlords should do a walk through prior to move in so that both parties can document any existing damages. Both parties should also do a walk through before move out so they’re able to discuss any new issues.

Pro Tip:

TurboTenant recommends landlords do inspections every few months while the tenant occupies their unit to document any ongoing issues.

If the tenant’s damages exceed the security deposit amount, consider sending a demand letter. This letter not only notifies the tenant that you will not be returning any of their security deposit, but it also demands additional funds from them. When demanding more money, it’s critical to have detailed, accurate documentation to back up your claims. This is especially important if your tenant refuses to pay and the issue escalates to small claims court.

Landlords should always weigh the pros and cons of taking a tenant to court. It ‘s likely only worth taking action if the amount owed is significant, there is proper documentation of damages, and the tenant has the financial ability to pay. If not, it is probably not worth spending the time and money required to take a tenant to court.

Learn more about how to make the most of security deposits while following the law in our webinar:

12 min read

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

11 min read

If you came here wondering how to write a lease agreement, look no further. Creating iron-clad rental contracts is essential for protecting the rights...

10 min read

Between the risks of running a business, a volatile and ever-changing real estate market, and the sometimes fickle attitudes of the renting...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado

The All in One Solution for Landlords

Over 550k landlords use TurboTenant to get leads, screen tenants, create leases, and collect rent — all in one place.