9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

Insurance is the kind of thing you don’t want to use but are always happy to have it when needed. Homeowners insurance is standard if you own property, but landlords don’t often think about whether or not their rental property is covered, and Illinois landlord insurance can help.

Landlord insurance was specifically created to protect landlords from rental catastrophes. In this guide, we’ll review the kinds of landlord insurance Illinois landlords can choose from and how much it can safeguard your investments.

There are a number of reasons why a landlord might need insurance, and Illinois landlords are no different. Landlord insurance can enable landlords to recover damages from various risk factors — environmental or human — depending on the coverage they opt for.

First, Illinois is known for extreme weather throughout the year, including tornados, heavy snow, and flooding near lakes and rivers. Second, Chicago is one of the country’s biggest and most volatile urban centers. Vandalism and theft are real challenges for some landlords in the Land of Lincoln, making landlord insurance a must.

For landlords, it may seem that renters insurance only covers your tenants. However, requiring tenants to carry a renters insurance policy can also help you.

When your tenant has a renters policy, you can reduce your chances of getting sued, rest assured that tenant belongings are covered, and find responsible tenants who understand the value of insurance.

Find out more in our article, “How Landlords Benefit from Renters Insurance.”

When it comes to the types of landlord insurance, Illinois landlords have a variety of coverages to choose from depending on the risks their property faces. Landlord insurance is typically broken down into three tiers, with each tier rising in price but offering higher coverage and payout levels for claims.

Here are the three tiers of Illinois landlord insurance.

The lowest tier of landlord insurance typically covers nine named perils, meaning it covers only damage related to these risk factors.

DP-1 insurance pays claims based on “actual cash value” (ACV), which factors depreciation into the claim calculation.

The named perils for DP-1 insurance are:

The middle tier includes the named perils from DP-1 but adds nine more to the coverage and pays out according to “replacement cost value” (RCV). This means insurance providers pay the amount needed to repair the damages from one of the 18 perils at the current market cost.

Additionally, DP-2 policies will also include fair rental value coverage, which pays missed rent payments due to an inhabitable unit resulting from one of the covered perils. Ultimately, the insurer will reimburse you for the fair value of the rent according to the local area.

Not all DP-2 policies include missed rent payments, as some insurers count this as add-on coverage. Check your policy documentation to find out where you stand.

The additional perils that DP-2 coverage includes are:

The highest tier of coverage is DP-3. It’s considered an open peril policy and will cover a wider range of damage types unless the plan specifically excludes them.

Often, this level of coverage will also include personal liability for the landlord, which will protect you if someone is injured on your property and the injured party sues.

Typical exclusions from DP-3 policies include:

Choosing landlord insurance can feel overwhelming, given the many providers in the marketplace, multiple coverage types, and add-ons. So, how do you choose the right one for you?

First, assessing your properties and identifying the most likely and serious perils you’ll face is important. If your property is new and in good repair, you might only need DP-1 coverage since the depreciation won’t be significant, and the risk of major structural damage from a peril might not be as consequential.

On the other hand, older properties could benefit from higher tier coverages since the higher replacement value claim payout would cover the replacement of depreciated assets.

Further, the choice of provider is also worth considering closely. Many landlords like bundling their landlord insurance with their other coverages. This makes it easier to keep track of and could result in cost savings.

However, providers only offering landlord insurance can sometimes deliver specialized plans serviced by highly knowledgeable agents.

There are a number of providers of landlord insurance Illinois property owners can pick from, but we’ve pulled together a few that might be of interest.

Steadily has quickly become a major player in the landlord insurance arena with competitive rates and comprehensive plans.

Pros

Cons

American Family Insurance offers a variety of insurance types for easy bundling and has overall positive reviews.

Pros

Cons

USAA is a Fortune 500 company that has been around for over 100 years. It provides insurance to military personnel and their families.

Pros

Cons

Liberty Mutual is a legacy insurance provider with a long nationwide insurance coverage history.

Pros

Cons

The cost of landlord insurance Illinois property owners can expect ranges quite a bit depending on the property you’re covering, the location of the property, and the coverage type and add-ons you need. Generally, though, landlord insurance averages around $1004 per year in Illinois.

Research each coverage provider carefully as you shop around since not all coverages are the same. Some companies automatically include things like fair rental coverage in the higher tiers, for example, but others require a monthly surcharge for that protection.

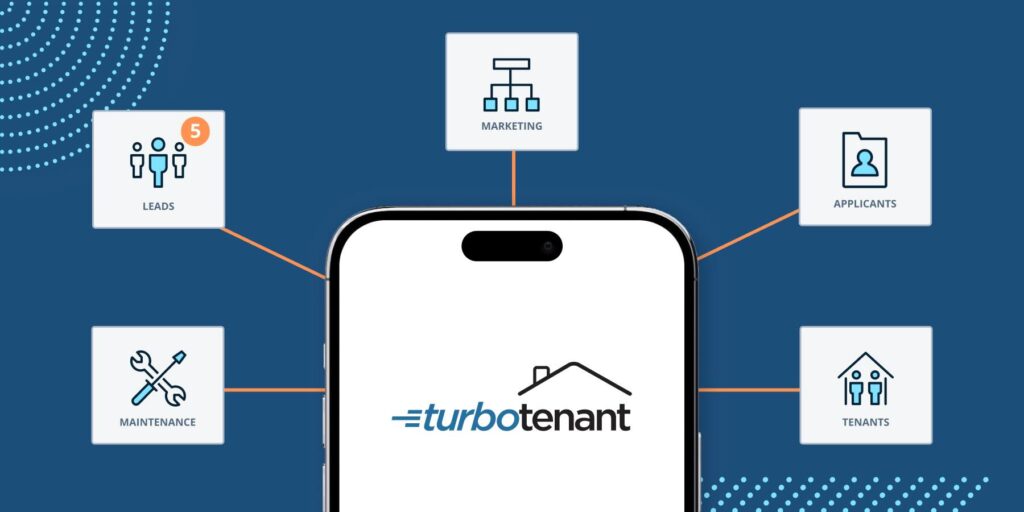

TurboTenant is high-quality property management software that has helped thousands of landlords streamline their day-to-day management operations and save time and money.

While TurboTenant doesn’t offer landlord insurance directly, we’ve partnered with Steadily to offer great coverage at affordable rates. Landlords should consider software like TurboTenant to help track documents and repairs, stay up-to-date on every tenant’s lease, and keep all aspects of their property management business in one safe, secure place.

For example, TurboTenant features online rent payments, comprehensive tenant background checks, and full-fledged rental accounting software that scales from one property to countless with just a few clicks.

Sign up for TurboTenant today to take your property management to the next level.

Landlord insurance is not required in Illinois, but it’s a great way to protect your investment if the unexpected happens.

No law in Illinois requires renters to carry renters insurance; however, landlords can choose to require it from tenants if it’s in the lease agreement.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...