12 min read

Beyond Traditional Loans: 14 Creative Financing Options for Real Estate Investing

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

As a landlord, it’s only natural that you want your tenants to pay monthly rent on time and in full. But what happens if your renter doesn’t make their typical payment on their due date? Collecting rent can be one of the most stressful parts of property management, but we’re here to ease the burden by sharing everything you need to know about late fees.

A late fee is a bill tenants must pay if they’re unable or unwilling to make their monthly payment on the established rent due date. However, you can’t send over an invoice as soon as the clock strikes midnight on the day rent is due. Some landlords are legally obligated to maintain a grace period, which is a set number of days between the due date and the day that late rent fees are triggered, during which the tenant can make their monthly rent payment in full without penalty.

Some local and state laws dictate the length of the grace period along with how much you can charge for a late fee, so be sure to brush up on your local landlord-tenant laws.

While you may not be inclined to charge your tenants for unpaid rent, we recommend reframing your perspective: a clearly outlined late fee clause in your written lease incentivizes your renters to pay you on time throughout their tenancy. It also helps you recoup some money in the event that your tenant’s monthly rent serves as your mortgage payment or other income. To further sweeten the deal for your tenant and make it even more likely that they consistently pay on time, we recommend you opt in to our rent reporting.

To begin, it’s crucial that your lease agreement outline your specific policy on late fees and the grace period you’ll allow before requiring the tenant to pay their bill. If your lease doesn’t have that information, you may want to check out other common mistakes new landlords make to ensure your piece of real estate is fully covered! We can help you add a late fee policy to your rental agreement with our lease addendums as needed.

If you’re adding a late rent addendum to your lease, you’ll want to be sure it outlines:

When in doubt, don’t be afraid to reach out to a local legal professional, particularly if you plan to accept tenants who are part of a rental assistance program.

As mentioned previously, it’s crucial to be well informed when it comes to your local landlord-tenant and state laws regarding nonpayment of rent to best understand your options.

Many states don’t specify how much the late fee can be, just that it must be a “reasonable fee.” A reasonable fee in this context means that you can’t charge your tenant an outrageous amount, no matter how frustrated you are with the situation.

For example, let’s say you’re a California landlord. California law says that late rent fees must be reasonable, but doesn’t offer any more guidance. If your CA rental unit costs $1,000/month, it would be unreasonable to charge your tenant $500 per day for late payments.

According to Flex.com, “late fees on rent tend to fall between 5-10%” of the amount of rent owed on a monthly basis. Revisiting our example, it would be reasonable for a California landlord to charge between $50-$100 as a late fee if their tenant is expected to pay $1,000/month in rent.

Other states have more specific rules regarding how much a landlord can charge tenants who fail to pay rent. In Maine, for instance, landlords “may not assess a penalty for the late payment of rent which exceeds 4% of the amount due for one month,” as outlined in the state’s civil code.

To learn the rules and regulations in your state, check out our landlord-tenant law guide.

It’s worth noting that most tenants genuinely want to pay their rent on time. If a normally-reliable renter is suddenly missing their monthly rent payment, we recommend checking in on them first and foremost. Reach out to say something like, “Hey, I noticed that you forgot to pay rent a few days ago, which isn’t like you! Are you okay?” Communication and compassion are key skills that all property owners should master, so don’t hesitate to touch base informally first.

If this tenant has a history of not paying their rent on time or if the normally-reliable tenant still owes you their rent check, send them a formal written notice that outlines:

Ideally, you and your tenant will be able to reach a solution that serves both parties. Perhaps that means working out a payment plan for one missed payment or otherwise allowing a partial payment, though only you know if your property management business can take that kind of hit. Maybe offering a cash for keys solution would be a better fit, local landlord-tenant laws pending.

Should the problem persist without a speedy resolution on the horizon, you’ll need to take the first step in the eviction process by sending a pay or quit notice.

Pro Tip:

Although the COVID-19 pandemic kicked off an eviction moratorium, it has since expired.

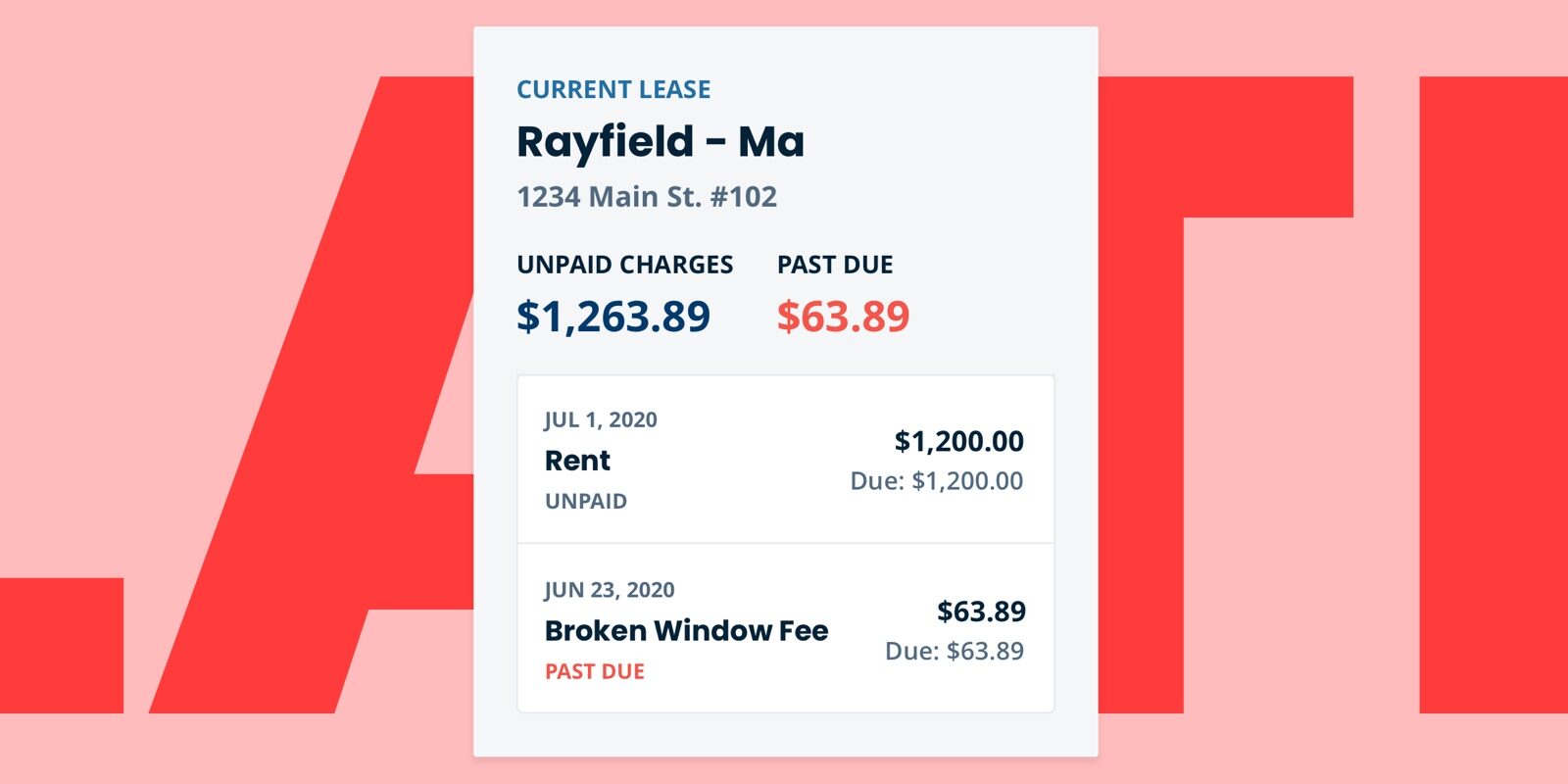

Collecting rent has never been easier with TurboTenant’s Rent Payments feature. Once your preferences are set, TurboTenant will automatically send reminders, receipts, and overdue notices to your tenants, ensuring a smooth and timely process.

You can also set up automatic late fees that trigger when a payment is overdue—whether it’s a one-time fee, daily accruing fees, or both. Customize the start date for when fees apply and set limits to keep everything compliant with local laws. TurboTenant takes care of the heavy lifting, making rent collection effortless and stress-free.

A late fee is a bill that tenants must pay if they’re unable or unwilling to make their monthly payment on the established due date.

While adhering to your local landlord-tenant laws, your lease’s late fee clause should detail:

Depending on your local landlord-tenant laws, you’ll either have to set your late fee as a percentage of the rent owed or set a reasonable flat fee.

What should I do if my tenant doesn’t pay rent?If your tenant usually makes their payments on time, check in on them informally. Most tenants want to pay their rent when it’s due, and missing a payment could indicate they’re going through a rough time. If your tenant has a history of not paying rent on time, send them a formal notice detailing:

If the problem persists, you can either try to find a solution outside of court (such as offering cash for keys or accepting a partial payment) or send a “pay or quit” notice to kick off the eviction process.

12 min read

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

11 min read

If you came here wondering how to write a lease agreement, look no further. Creating iron-clad rental contracts is essential for protecting the rights...

10 min read

Between the risks of running a business, a volatile and ever-changing real estate market, and the sometimes fickle attitudes of the renting...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado