9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

Rentals provide a great vehicle to generate passive income, but California property owners might kiss their investments goodbye without the proper landlord insurance.

Hypothetically, let’s pretend a fire, flood, theft, or other unfortunate event damages your rental. If you think homeowners or renters insurance will cover your expenses, think again. Landlord insurance is the only way to protect your rental property from such catastrophes.

To help you further understand landlord insurance, this guide will cover:

In short, landlord insurance protects against financial losses from property damage, legal fees from injuries on an owner’s property, loss of rental income due to a covered event, and more policy-specific occurrences.

Property owners who want to protect their rentals can only do so by investing in landlord insurance. Homeowners insurance applies only to one’s primary residence (but not to their rental properties). Rental insurance protects a renter’s possessions (but not the actual rental property itself).

Natural disasters, vandalism, theft, and other common events affecting rentals are unpredictable and out of a landlord’s control. The proper insurance policy will protect against these unforeseen events and compensate property owners when their investments are damaged, stolen, or destroyed.

Average costs for California landlord insurance range from $896 to $1,728 a year. Where a landlord can expect to fall within this spectrum depends on the value of their property, which insurance company they choose, and what level of coverage they enroll in.

To reiterate, landlord insurance doesn’t cover any of the renter’s possessions. If renters want to ensure that everything under their roof is insured, they should opt for renters insurance, which typically costs between $148 and $187 annually.

There are three tiers of landlord insurance. Here’s what to expect from each:

Even the most comprehensive coverages don’t cover certain events. Here are a few typical add-ons you can bolt onto your insurance policy to round out your coverage:

If you’re a landlord searching for an insurance policy to protect your California rentals, look no further than these four widely-trusted companies:

We recommend Steadily landlord insurance above all other options on the market. With a 4.5-star rating on Trustpilot, Steadily comes highly recommended by thousands of happy customers.

Pros

Cons

Founded in 2017, Obie Insurance hasn’t been around for long, but they’ve quickly made a name for themselves by offering affordable policies in all 50 states.

Pros

Cons

If you’re looking for affordable landlord insurance from a trusted authority, consider State Farm (especially if you want to bundle it with car, homeowners, or other types of insurance).

Pros

Cons

Much like State Farm, Farmers Insurance is a widely-used powerhouse landlord insurance provider that allows for bundling with other types of insurance policies.

Pros

Cons

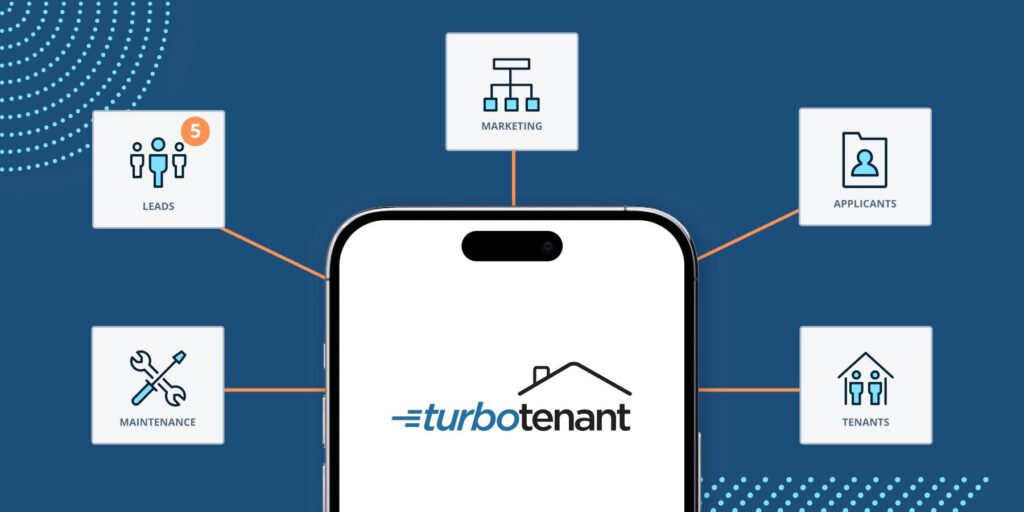

We don’t offer landlord insurance at TurboTenant, but we do offer landlords a highly streamlined property management experience through our free, easy-to-use software.

Here are a few ways TurboTenant can help you better manage your rentals:

Sign up for TurboTenant today to take your property management experience to the next level.

Yes. Though renters insurance isn’t required by law, landlords can require tenants to sign up for a policy in their lease agreements.

No, landlord insurance isn’t legally required in California, though we highly recommend it.

No, homeowners insurance only applies to owner-occupied homes. If you want to cover your rental, you’ll need landlord insurance.

No, you can’t deduct homeowners insurance on your rental property in California. Homeowners insurance only applies to your primary residence, and its premiums aren’t tax-deductible.

You can, however, deduct the premiums you pay for landlord insurance, which is considered a business expense for property owners using rentals to generate income.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...