9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

Did you know that almost 80% of renters’ first call during a maintenance issue is to their landlords? If you want to protect your monthly revenue, it pays to plan ahead – literally. Let’s examine how the average cost of rental appliance repairs, along with how much you should save to cover unexpected issues.

As a landlord, you should expect to have a minimum of one to two breakdowns per unit per year, so it’s important to have a budget for repairs and replacements in your rental property. While the exact amount can vary depending on factors such as the age and condition of the systems and appliances, as well as your specific property, a general guideline is to budget around 1%-2% of the property’s value for annual maintenance and repairs.

Here’s a step-by-step approach to help you calculate a rough estimate:

For example, if your property is valued at $200,000, the estimated annual maintenance and repair budget would be:

So, in this scenario, you should aim to set aside between $2,000 and $4,000 per year for maintenance and repairs.

Keep in mind that this is a general guideline, and the actual costs can vary. It’s also important to regularly assess the condition of your property, keep track of maintenance expenses, and adjust your budget accordingly. Additionally, having landlord insurance or warranties on your systems and appliances can help mitigate unexpected costs.

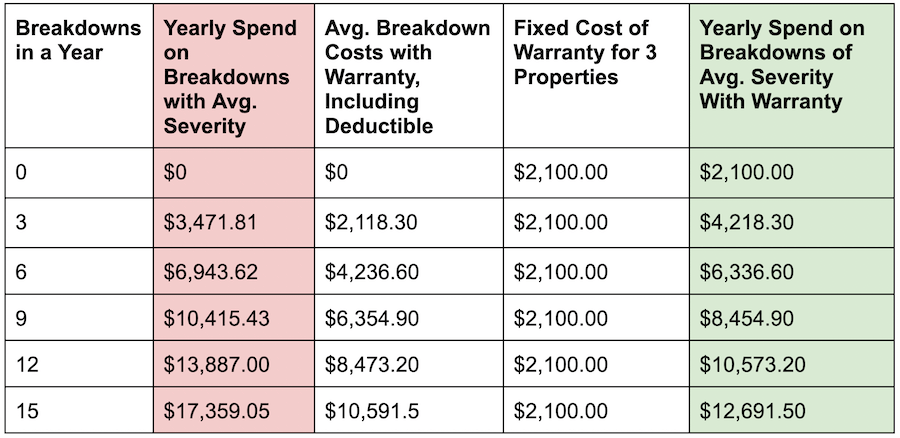

Armadillo Home conducted a case study reviewing breakdowns, repairs, and replacements for a landlord with 200 rental units:

The Severity of Average Breakdown

The average costs of appliance repairs and replacements can vary depending on various factors such as the type of appliance, the specific issue, the location, and the service provider.

Managing multiple rental properties can be challenging, especially when it comes to maintenance and repairs. Unforeseen expenses can quickly accumulate and affect your profitability. However, by implementing cost-saving measures and strategies, landlords can mitigate repair costs and achieve budgetary stability.

To that end, a home warranty is an excellent tool for landlords with multiple rental properties seeking budgetary stability. By investing in a home warranty plan, you can protect yourself from unforeseen repair costs and maintain a more predictable budget. Home warranties typically offer coverage for major appliances and systems, ensuring that repairs are handled promptly and professionally. With a home warranty, you pay a fixed premium, which helps you forecast and manage repair expenses effectively.

Additionally, you should:

For landlords managing multiple rental properties, implementing cost-saving measures and strategies is crucial to achieve budgetary stability and reduce repair expenses. By conducting regular inspections, creating an emergency fund, cultivating relationships with reliable contractors, encouraging tenant responsibility, and utilizing a home warranty, landlords can streamline their repair processes, minimize financial uncertainties, and maintain profitability. By adopting these strategies, landlords can protect their investments and ensure that their rental properties remain lucrative and well-maintained in the long term.

Looking for a home warranty to protect your investments? Armadillo Home offers an exclusive home warranty deal for TurboTenant landlords.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...