9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

Although it’s impossible to predict with certainty who will make the most reliable tenant, tenant screening gives you the best picture of someone’s background and financial history so you can confidently pick the right renter for your property. The most important indicator if a tenant can and will pay rent is an applicant’s credit score.

But what if an otherwise perfect tenant has a low credit score?

That’s when requiring a co-signer on the lease comes in. Below, we will guide you through what a lease co-signer is, the pros and cons of adding a co-signer, and how to add a co-signer to a lease.

Marketing. Applications. Leases. Payments.

Marketing. Applications. Leases. Payments.

A co-signer is someone who jointly signs a loan or a lease with another person to guarantee payment. Most people are familiar with co-signers when it comes to taking out a loan – for example, if someone is young or has had financial troubles, loan companies often require co-signers. In the same way a co-signer takes financial responsibility for a loan, a co-signer on a lease is taking the financial responsibility for paying rent or other charges related to the property if the tenant fails to pay.

Because co-signers are legally accountable for ensuring the rent gets paid, landlords can feel more confident in renting to a particular tenant. Co-signers are often parents, relatives, or even close friends of a renter.

After you run a tenant screening report, you may discover your prospective renter has a lack of credit history or a poor credit score along with their collections, bankruptcies, and lines of credit.

Renting to tenants who have a low credit score means they could have a history of missing payments, which is usually a red flag. But sometimes renters are young, such as college students, and might not even have a credit score yet. This is often when a parent or family member would come in as a co-signer on a lease to guarantee the rent as their financial responsibility.

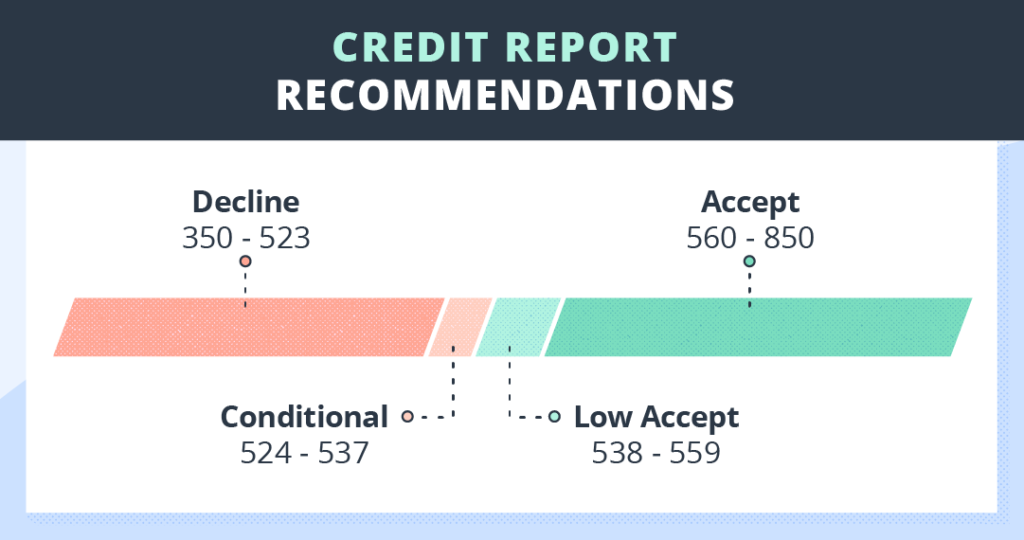

Because credit scores can range, landlords need to determine what their renting criteria will be; some might be okay with more risky acceptance renting criteria than others. Below are general accept-and-decline credit score guidelines to consider:

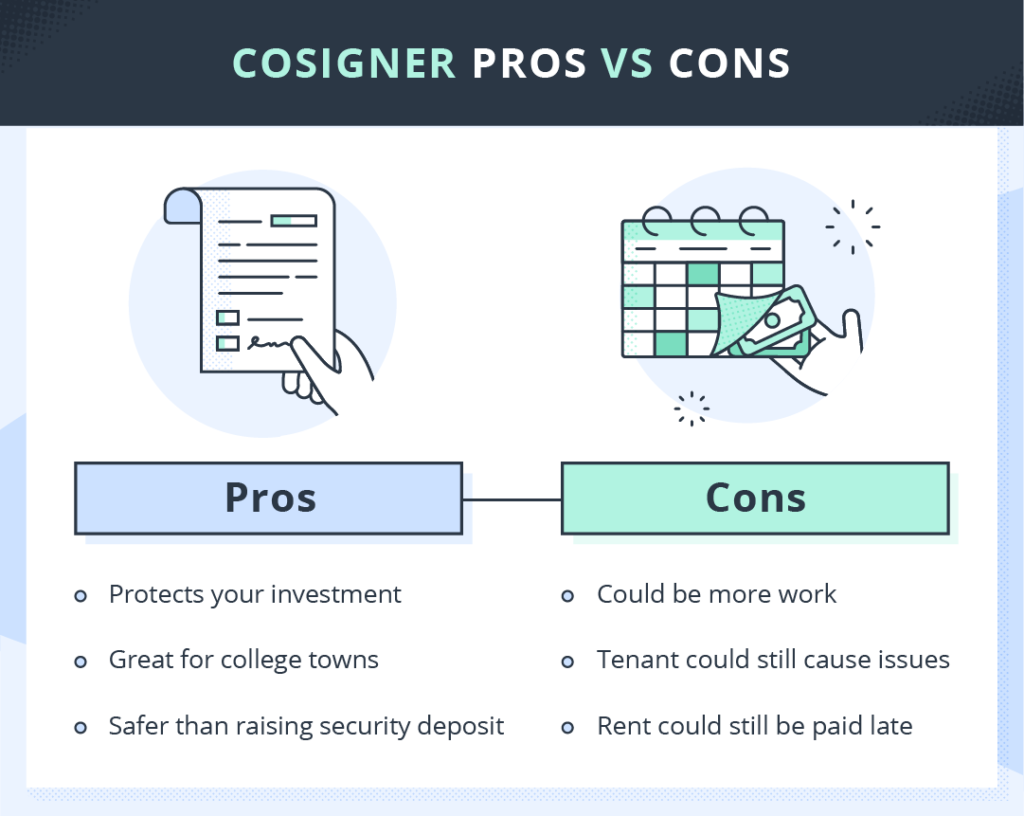

As you debate whether to rent to a specific renter with a co-signer or to choose a different applicant, it’s important to assess the pros of having a co-signer on a lease:

Ultimately, if you have other great applicants that wouldn’t require a co-signer, it might save time and make sense for you to rent to a different person that meets your renting criteria by themselves.

It is highly recommended that you have a co-signer lease agreement outlining the responsibility they are taking over as it’s important for you to have a written record of the relationship. Be clear about the terms so misunderstandings don’t arise later.

The process of adding a co-signer to a lease is fairly straightforward – here’s a step-by-step breakdown:

Adding a co-signer to a lease will protect your rentals and increase the ROI of your property investment. Understanding and setting your renter acceptance criteria from the get-go will help you stick to your policies and be clear with applicants while also following Fair Housing laws. If you have recently added a cosigner to a lease, don’t forget to set up online rent payments to make it more convenient, fast, and secure for everyone.

Relatives like parents, good friends, or even a co-signer service are all excellent choices for a co-signer. If your applicant opts to use a relative or friend, the most common co-signers, there are a couple of things to note:

When it comes to needing a co-signer, there is absolutely nothing to be ashamed of. If anything, a co-signer serves as proof that someone trusts your applicant enough to vouch for their credibility and responsibility.

It’s crucial that your tenant extend the same respect to their co-signer as they do for you. They can achieve this by paying rent on time, taking care of your rental property, and maintaining open communication with both their co-signer and you as a landlord.

You should always screen co-signers as they will take responsibility for missed rent payments when the renter fails to pay. Tenant screening will confirm the co-signer can afford to take the financial repercussions.

If a tenant refuses to have a co-signer, it could be another red flag – they might not be the best fit for your property. If you have streamlined your rental marketing online, you will hopefully receive many renter leads interested in your property that will match your rental acceptance criteria better.

While you will decide specific arrangements with the tenant and the co-signer, typically the co-signer will only pay the fees and rent when the renter fails to do so – they are a backup. In some other cases, like with students and parents, co-signers agree to pay the rent every month on behalf of the renter.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...

Create a Custom Lease Agreement

State-specific lease agreements keep you and your tenant safe. TurboTenant makes it easy to store your rental agreements, e-signatures, and addendums!