9 min read

How to Get Property Management Clients (Lead Gen Methods)

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

While the national unemployment rate lowered to 5.9% in June 2021, many landlords across the country may still be facing the grim reality that their tenant is unable to pay rent, and as a result, may not be able to pay their rental mortgage.

Mortgage relief is on everyone’s mind, and with the eviction moratorium set to expire on July 31st, 2021, landlords may be considering evicting their current tenant(s) for non-payment of rent so they can find another tenant who is able to pay. However, as most landlords know, evictions are both expensive and time consuming.

A new form of relief available to landlords is mortgage forbearance – a mortgage relief program for landlords set up by the federal Coronavirus Aid, Relief, and Economic Security Act (CARES Act) that was established in response to Covid-related financial hardship.

In this guide, we will walk you through everything you need to know about mortgage forbearance and additional relief.

Mortgage forbearance is when your mortgage servicer or lender (the company where you send your monthly payments) allows you to temporarily pause or reduce your mortgage payments while you build up your finances.

Mortgage forbearance came into effect under the CARES Act, which became national law on March 27th, 2020. Under the act, landlords may be eligible for mortgage relief if their tenants’ inability to pay rent caused financial hardship during the pandemic.

It’s important to remember that forbearance does not mean that your mortgage payments are erased. You will still have to pay back the full amount of missed payments. However, as long as your initial forbearance is activated under the CARES Act, your loan servicer cannot ask you to repay all the missed payments at once, instead, you will be allowed to repay them over time.

There are only two requirements for forbearance eligibility. The two requirements include:

Under the CARES Act, your servicer or lender cannot deny your forbearance request, but keep in mind different servicers have varying requirements to qualify for mortgage forbearance. Servicers of mortgages that are not federally backed, such as privately-owned mortgages, may still offer similar forbearance options. If you are struggling to make your mortgage payments due to pandemic-related financial hardship, your servicer is generally required to discuss payment relief options with you.

Unsure if you have a government-backed loan? You can easily find out. To do so, reach out to your mortgage servicer (use Mortgage Electronic Registration Systems (MERS) if you don’t know your servicer), or check online with loan lookup tools provided by Fannie Mae or Freddie Mac.

First, to initiate a mortgage forbearance, you will need to contact your servicer or lender.

Because of the CARES Act, you will not need extensive documentation to prove your financial hardship. You’ll simply need to affirm your financial hardship on a standardized forbearance request claim form.

Mortgage forbearance will not happen on its own. Do not stop paying your mortgage until you’ve spoken with your servicer or lender. Not paying your mortgage before you are in forbearance will severely harm your credit.

Originally set to end on June 30th, 2021, the deadline for requesting an initial forbearance was extended to September 30th, 2021 for loans backed by HUD/FHA, USDA, or VA. If your loan is backed by Fannie Mae or Freddie Mac, a deadline is not currently in place for requesting an initial forbearance.

Concerning the length of your forbearance, your initial forbearance can last anywhere from three to six months. But if you need additional time to recover financially, you can request an extension on your current forbearance. Once again, you must contact your servicer or lender to initiate the extension. Your forbearance may be extended for up to 12 months or longer, depending on your loan.

Important note: No matter when your forbearance is set to end, you always have the right to stop the forbearance at any time. Additionally, if you are able, making partial payments on your mortgage during the forbearance will ensure fewer payments to catch up on after the forbearance ends.

In the short term, forbearance can act as a once-in-a-lifetime mortgage relief for landlords struggling with financial hardship due to the economic fallout of the pandemic. It can be very beneficial for landlords in several ways:

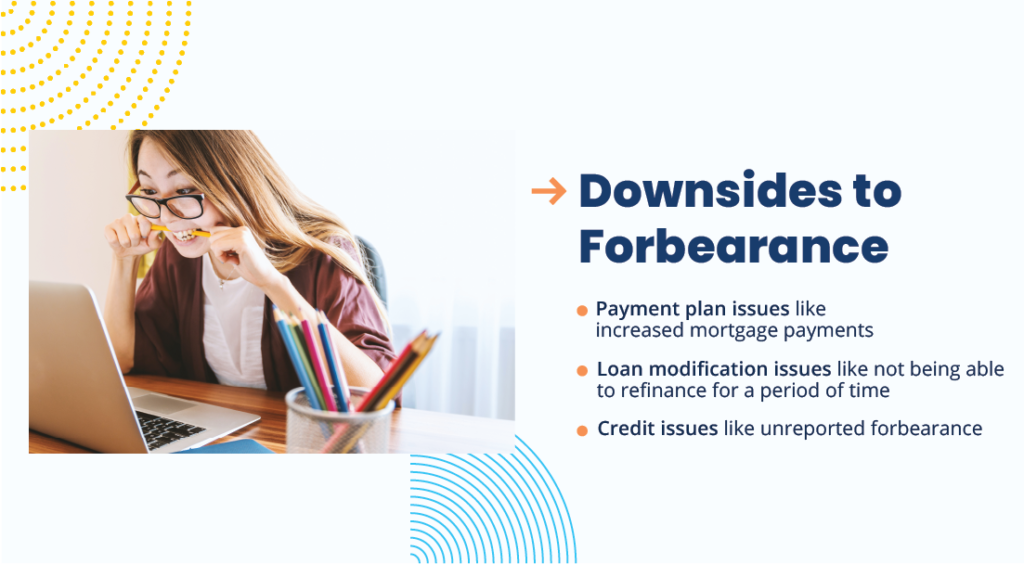

While mortgage forbearance can act as an immediate lifeline, it does have its downsides. Some of the downsides to a forbearance you could encounter include:

If you’ve decided that a mortgage forbearance isn’t the best option for you, there are alternatives. Below, you’ll find an outline of potential mortgage and rent relief options:

Mortgage forbearance can serve as a great mortgage-relief option for landlords at risk of damaging their credit score or going into foreclosure. Ultimately, it’s up to you to decide what type of relief best fits your unique landlord situation and long-term goals as a property investor. When it comes time to consider a new renter, don’t forget thorough tenant screening is an essential part of the rental application process to protect your investment. Screen your tenants for free today.

Disclaimer: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state, and federal laws, and consult legal counsel should questions arise.

9 min read

With such a competitive and fast-paced real estate market, especially rental markets, knowing how to get property management clients is crucial for starting and...

8 min read

Condo property management, on its face, is exactly what it sounds like — overseeing one or many units in a condominium building...

7 min read

Finding the ideal commercial or residential rental property can be challenging for renters, as it may only meet some of their specific...