12 min read

Beyond Traditional Loans: 14 Creative Financing Options for Real Estate Investing

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

As a landlord, getting a tenant screening report is arguably one of the most essential steps in the rental process. The word “tenant screening” might be unfamiliar to you if you are a new property investor – however, you are probably familiar with the terms credit check, background check, and eviction history. These are what make up the bulk of tenant screening. Landlords who are looking to sustain a positive ROI on their investment property know they need a great tenant who pays rent on time, doesn’t cause trouble, and is overall a match for their property, to find that match, start with a tenant screening report.

More importantly, you can potentially avoid spending thousands of dollars in property damages, evictions, or unpaid rent. Luckily, in today’s digital world, we have access to more information and resources than ever before to aid in the process of choosing the right tenant.

Below we have outlined what tenant screening is, why it’s a valuable investment, and how to get started so you can run your rental business smoothly and without worry:

As mentioned previously, when we refer to tenant screening, we are actually referring to a variety of actions a landlord takes to gain a clearer picture of an applicant before renting to them. The goal of tenant screening is to weed out applicants that are a higher risk for missed payments, damage to your property, or evictions.

Tenant screening involves all or some of the following depending on the landlord’s approach:

It is important to note that depending on the state you are in, there may be different laws and regulations surrounding tenant screening. As a landlord, you should ensure you are educated in these laws before you begin the screening process so you can always follow the law as a landlord. For example, while it is fine in most of the country to choose not to rent to those with a criminal background, it is illegal to do so in the city of Seattle as a part of their Fair Chance Housing initiative.

One of the most important sets of regulations you should familiarize yourself with are Fair Housing Laws, including both federal and state-specific regulations. These laws prevent discrimination against protected classes and serve as guidance for what you are allowed to use as criteria for choosing renters. You cannot refuse housing based on race, color, national origin, religion, sex, familial status, or disability.

With approximately 29.5 percent of adults having a criminal record, according to the FBI, it is understandable that landlords consider this an important part of the tenant screening process. Although some cities, as mentioned above, have taken a stance against using this as part of rental criteria, it is still a widely used screening criteria for landlords.

It might seem obvious why a tenant background check is essential, but it’s important to get an in-depth insight into a tenant’s past. A criminal background check pulls from several databases including the following:

A criminal background check will help protect you, your property, and the community where your rental is located. Without a criminal background check, landlords could potentially be missing several red flags.

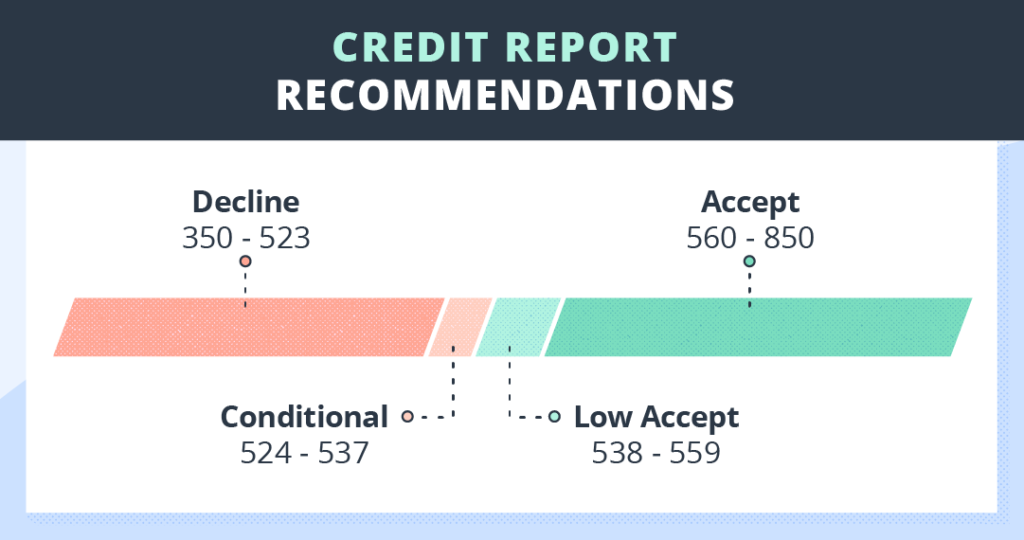

Running a credit check is an important aspect of tenant screening because if someone has a low credit score, it may mean that they have a history of missed payments. You want to avoid having to evict tenants due to non-payment, so you should protect your investment by checking a renter’s credit.

Here is a good guide for acceptable credit score recommendations, generally you want to stay above 538 and stay away from scores in the 300s:

However, there are a few workarounds for someone who has a low credit score or is just beginning to build their credit – for example, you may be renting to a new college student who probably hasn’t built their credit yet. In this case, you can request a co-signer so both parties are responsible for paying rent – it’s important you also screen the co-signer to check for any red flags.

Along with a credit check, it’s recommended you collect pay stubs or employment verification from renters as another assurance they can afford rent every month. Someone might have a great credit score, but be out of a job, so collecting pay stubs is an additional way to confirm – check out our tips on how to identify fake pay stubs.

Sometimes the risks go far beyond renting to someone with a criminal background or bad credit score. One of the most important reports you can read is someone’s eviction history. Getting past references from previous landlords to understand the eviction might be useful to you as well.

Known in the landlording industry as “professional tenants,” some renters know the eviction process inside and out and use this knowledge to their advantage. One quick credit check and eviction history report can save a landlord from thousands of dollars in legal fees, lost rent, and property damage.

While the processes mentioned above are to gather the hard data and information on your potential tenant, there are also soft tenant screening methods you can use. Here are some examples:

Getting to know your potential tenant will help you choose the best candidate for your property while also starting communication off on the right foot.

Historically, tenant screening was a difficult process that led many landlords to rely on trusting their gut. However, today screening tenants is straightforward, simple, and accessible to independent landlords as well as property managers. Through TurboTenant, the screening process is simple and fast:

We also strongly encourage landlords to perform their own interviews with tenants, as well as verify employment and contact previous landlord references.

The moral of the story is to never cut corners on tenant screening. While you may be an outstanding judge of character, it is not always possible to gain the full picture of a tenant without a little help from tenant screening tools. When a renter knows you will be checking into their background and credit, they are less likely to believe they can scam you. For those who still choose to undergo the screening process, you will be offered the information you need to make an educated decision about whether or not they will make a trustworthy tenant.

No, tenant screening is optional, but it is highly recommended so you can safeguard your property investment and ensure you have a trustworthy tenant who will pay rent on time and fit the property.

Yes, tenant screening is legal – however, some states might have specific requirements when it comes to fees and what is discriminatory so always make sure to check your local and state laws.

Through TurboTenant, a tenant screening report costs $55. Remember, tenants usually pay the screening fee when applying to your property. For more details on what’s included on each report, visit here.

If you’re new to screening tenants or TurboTenant, we have a full guide on how to read a screening report so you can identify where red flags might be and understand what you’re looking at when you receive a report.

12 min read

Creative financing can offer real estate investors options beyond traditional lending from banks. If you have less-than-ideal credit or lack a sizeable...

11 min read

If you came here wondering how to write a lease agreement, look no further. Creating iron-clad rental contracts is essential for protecting the rights...

10 min read

Between the risks of running a business, a volatile and ever-changing real estate market, and the sometimes fickle attitudes of the renting...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado