In this edition of The TurboTenant report, we will be focusing on the best places to buy an investment property in Washington. Three towns made our list: Kent, Seattle, and Tacoma. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

It’s nice to have Washington on your side – and we aren’t talking about the capitol or the president. Washington state is a thriving and beautiful place with a great mix of urban culture and nature. In this state, you’ll find the Cascade Range, Mt.Rainier, and the Puget Sound – there is never-ending beauty and outdoor recreation for residents. Washington is the lead producer of lumber in the country with its vast forests housing Douglas firs, ponderosa, and more. However, several different industries call Washington home such as agriculture, technology, maritime, and health – many people are flocking to work and live in this flourishing state. It is a place for all ages as it modernizes its culture and economy; Washington expects to be coal-free by 2025 while also being one of the first states to legalize recreational marijuana.

Grab your raincoat because you won’t want to miss out on what Washington has to offer – let’s take a look at the best places to buy an investment property in The Evergreen State.

The Best Cities to Buy an Investment Property in Washington

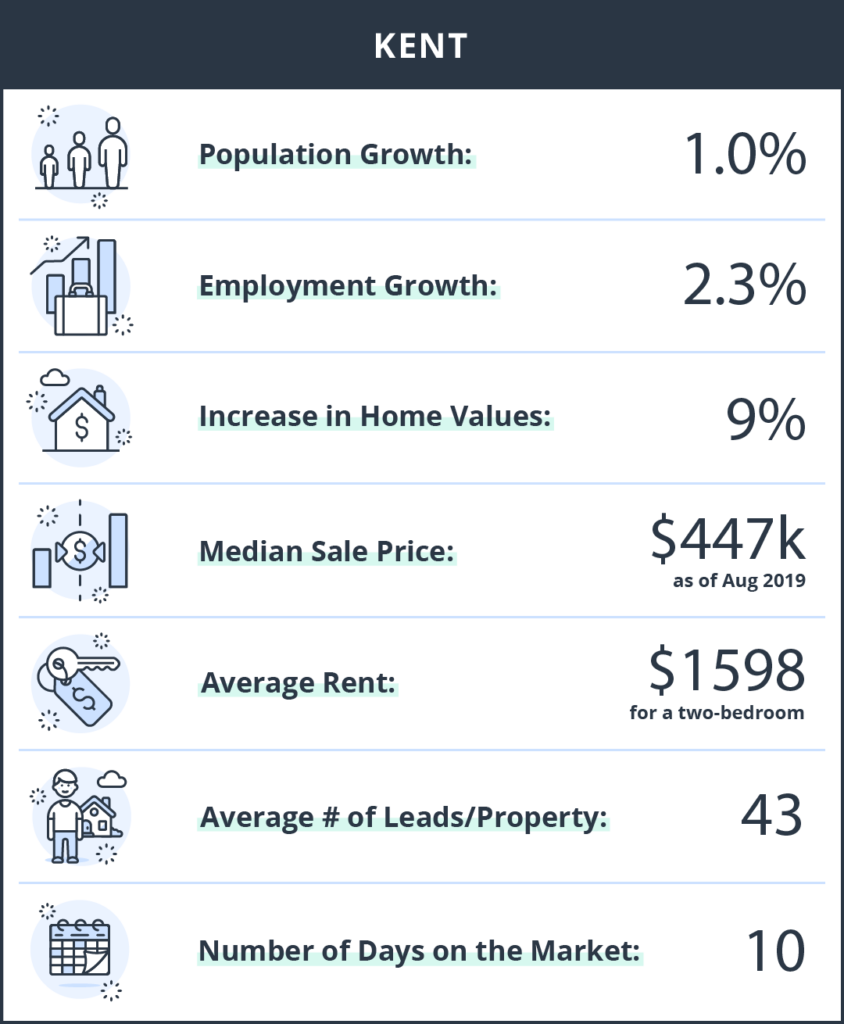

#3: Kent

Famously known as the lettuce capital during the 1920s, Kent is now the fourth largest manufacturing and distribution center in the United States where companies such as Boeing Space and Defense, Amazon, REI, and Starbucks have plants. It’s only 19 miles south of Seattle, but the cost of living is half the price with the average rent being $1,598 making it very attractive for both renters and property investors. Its population and employment growth is due to the fact that Kent has a great culture where 138 languages are spoken and there are great amenities such as over 70 parks, biking trails, family-friendly activities, great dining, and craft beer. Landlords can be expected to fill their properties in 10 days or less with an average of 43 leads per property!

- Population growth: 1.0%

- Employment growth: 2.3%

- Increase in home values: 9.0%

- Median Sale Price: $447k

- Average Rent: $1,598

- Average Number of Leads per Property: 43

- Number of days on the rental market: 10

#2: Seattle

The Emerald City, or Seattle, is more than just green year-round, you get the best of both worlds with city-life and also the beautiful nature surrounding the metro-area. From the more famous Pikes Place Market and the Space Needle to coffee shops and art galleries, Seattle is a diverse and thriving scene as is obvious by the high population growth, employment growth, and increase in home values. While the average rent can be seen as pricey for the state, the Seattle neighborhoods from Chinatown to Capitol Hill all have their own unique personalities in need of rentals. It’s also a great place to raise a family with low crime rates and excellent education and public schools – don’t forget the University of Washington students who are the perfect candidates for renting. With a solid number of leads per property and an average of two weeks on the market, landlords won’t have to be sleepless in Seattle when filling their rentals.

- Population growth: 5.9%

- Employment growth: 3.3%

- Increase in home values: 11.3%

- Median Sale Price: $675k

- Average Rent: $2,495

- Average Number of Leads per Property: 18

- Number of days on the rental market: 14

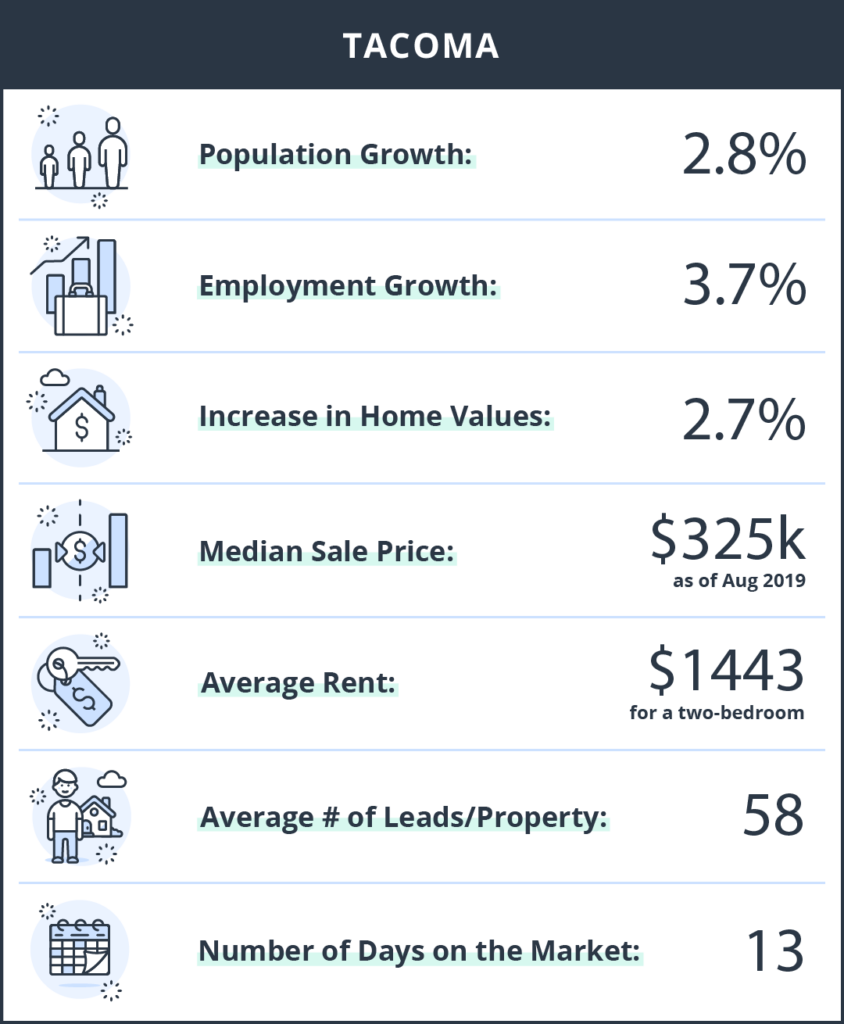

#1: Tacoma

Tacoma is the creativity hub of Washington, with a large community of musicians, artists, photographers, writers, and many passionate businesses contributing to the vibrant community – Dale Chihuly, renowned glass artist was born here, as is obvious with his artwork integrated throughout town. Tacoma is clearly on the rise with population and employment steadily growing with an extremely affordable rent compared to Seattle. It can somewhat be described as a college town with students from University of Washington Tacoma, the University of Puget Sound, and the Pacific Lutheran University all living in the city helping landlords make a constant and consistent business. Of course, locals will never be bored with a large selection of museums, parks, golf courses, and hikes to see views of Mt. Rainier. In The City of Destiny, landlords are destined to find the right renter as it claims the highest number of leads per property in the state.

- Population growth: 2.8%

- Employment growth: 3.7%

- Increase in home values: 2.7%

- Median Sale Price: $325k

- Average Rent: $1,443

- Average Number of Leads per Property: 58

- Number of days on the rental market: 13

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

Use our handy map tool to explore top rental markets throughout the U.S.

About the TurboTenant Report

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

Methodology:

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

Sources:

- TurboTenant Rental Data

- Fastest Growing States Population

- The Best and Worst Cities to Own Investment Property

- Real Estate data provided by Redfin, a national real estate brokerage.