In this edition of The TurboTenant report, we will be focusing on the best places to buy an investment property in South Dakota. Two towns made our list: Sioux Falls and Rapid City. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

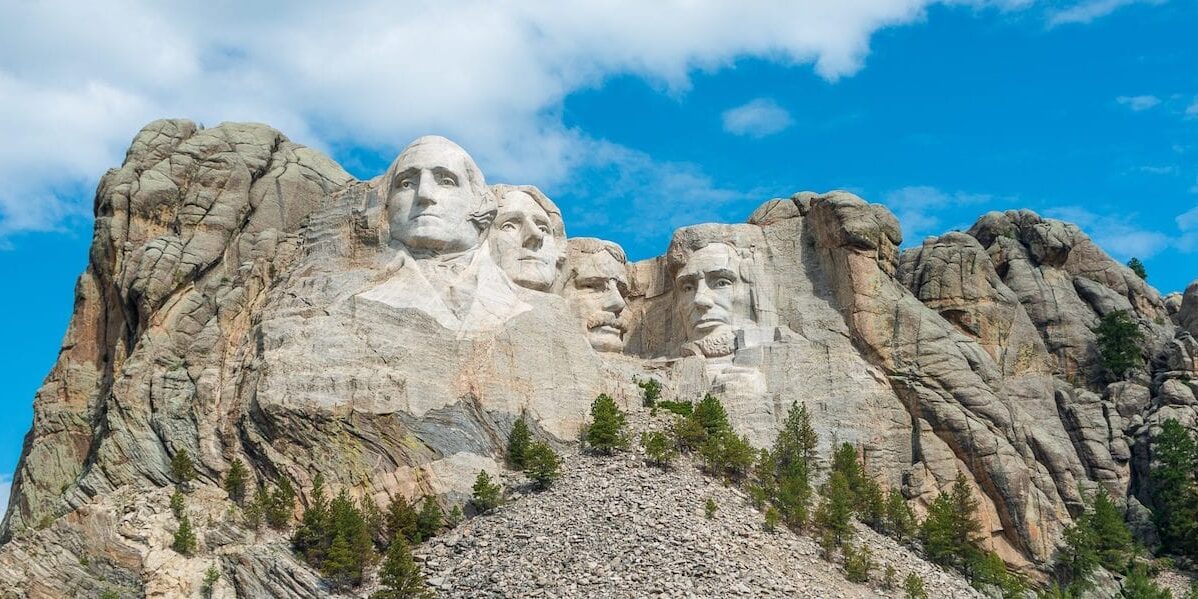

You can’t forget South Dakota’s state slogan – great faces and great places. While Mount Rushmore, a national memorial, might be the most well-known part about this state, there is so much to explore. From the Blacks Hills and the Badlands to the Missouri River, there are busy cities, beautiful country landscapes, and great towns that are very affordable compared to many states. There is a strong Native American population that provides beautiful culture, art, and community. South Dakota’s economy is largely based off of tourism as well as agriculture – historic sites such as Deadwood and the Crazy Horse Memorial bring residents and visitors from all over. South Dakota’s relaxed environment and family-friendly communities make it a prime location for property investors.

Let’s see where the best places to buy a rental investment property in The Mount Rushmore State are.

#2: Sioux Falls

Sioux Falls is in the heart of America and it might steal your heart with its positive numbers for property investors. It’s a great mix of big-city with a small-town feel. There’s more than 650 restaurants, excellent shopping, and many festivals year-round. Sioux Falls boasts clean air and water, low unemployment, and affordable living – this is evident with its 4.7% population growth and 3.4% employment growth. Landlords can expect only eight days on the market and a solid 12 leads per property – you won’t have to worry about filling your properties with trustworthy tenants.

- Population growth: 4.7%

- Employment growth: 3.4%

- Increase in home values: 4.3%

- Median Sale Price: $231k

- Average Rent: $816

- Average Number of Leads per Property: 12

- Number of days on the rental market: 8

#1: Rapid City

As the second largest city in South Dakota, Rapid City is a center for commerce, culture, tourism, and agriculture. Rapid City is the gateway to many attractions such as the Black Hills, Mount Rushmore National Memorial, Badlands National Park, and the Crazy Horse Memorial. Fun fact: it has a large amount of public sculptures on display all over the city including a series of life-size American presidents. Rapid City is also home to the South Dakota School of Mines and Technology – a highly rated engineering university. Property investors can expect a median sale price of $293k with a 10% increase in home values! Furthermore, with a large population of students and families, landlords will only have to market their properties for four days while getting around 17 leads per property. Sounds like our #1 town in South Dakota!

- Population growth: 2.7%

- Employment growth: 1%

- Increase in home values: 10%

- Median Sale Price: $293k

- Average Rent: $903

- Average Number of Leads per Property: 17

- Number of days on the rental market: 4

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

Use our handy map tool to explore top rental markets throughout the U.S.

About the TurboTenant Report

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

Methodology:

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

Sources:

- TurboTenant Rental Data

- Fastest Growing States Population

- The Best and Worst Cities to Own Investment Property

- Real Estate data provided by Redfin, a national real estate brokerage.